Key Takeaways

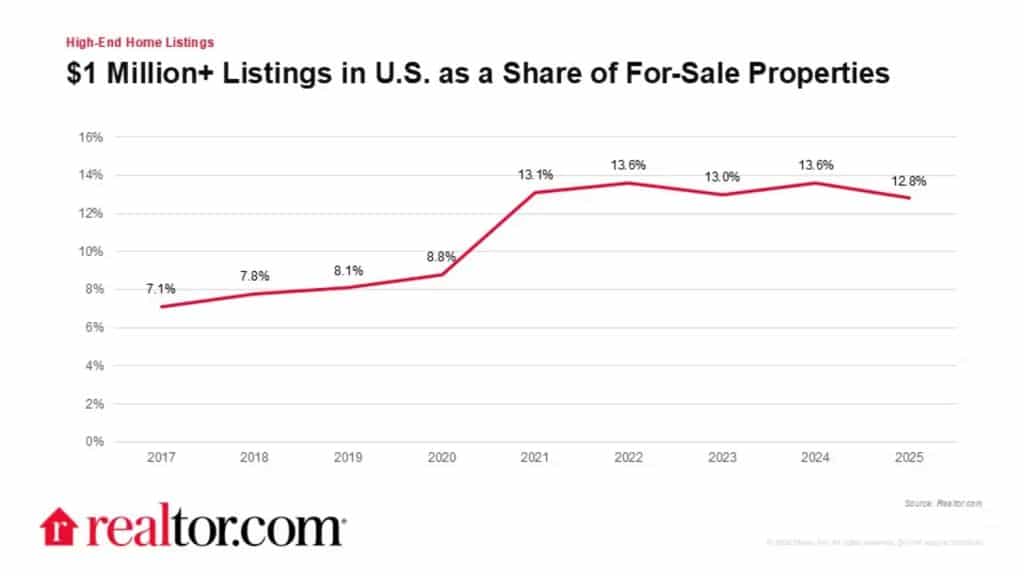

- The luxury housing market, characterized by homes priced over $1 million, continues to outperform the broader U.S. housing market.

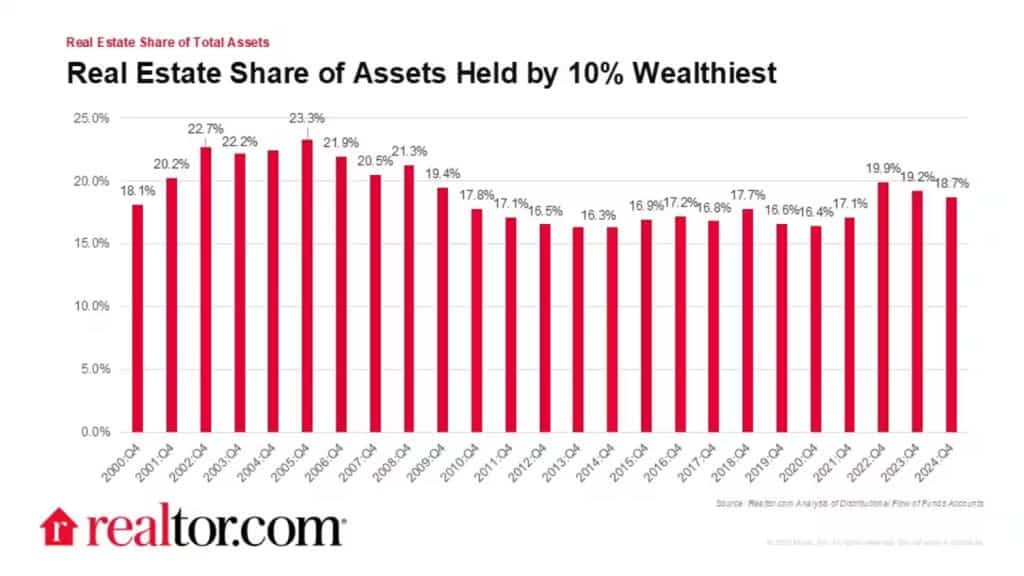

- The total value of private real estate in the U.S. hit $48.1 trillion by the end of 2024, highlighting significant growth, particularly benefiting the wealthiest 10% of Americans.

- Despite market volatility and policy uncertainties, demand for luxury homes remained stable in the first quarter of 2025.

- Luxury homes made up a smaller share of the total listings but accounted for a larger portion of sales compared to the previous year.

- The Los Angeles metro area leads with the highest share of million-dollar listings, followed closely by San Francisco and Boston.

- The average time taken to sell luxury homes has remained consistent, while homes under $1 million are taking longer to sell and are experiencing more frequent price cuts.

- Economic factors and market performances, including the impact of global tariffs, contribute to uncertainty in the housing market.

The luxury housing market in the United States has been a dominant force, consistently outstripping the general real estate sector. Homes priced over $1 million are not just a symbol of opulence but have become a significant aspect of real estate dynamics, showcasing unwavering demand even amidst broader market uncertainties. In this blog post, we delve into the intricate workings of the luxury housing market, how it compares to the general real estate market, and the factors spearheading its growth.

Understanding the Landscape of the Luxury Housing Market

The luxury real estate market stands out with its notable ability to command greater buyer attention and market share than its more conventional counterparts. By the end of 2024, the private real estate market in the U.S. had hit a staggering value of $48.1 trillion, markedly benefiting the wealthiest 10% of Americans. This surge underscores the strong appreciation in property values over the years, which was particularly pronounced for luxury assets.

Key Performance Metrics

- Sales and Listings Discrepancy: While luxury homes only constitute a nominal fraction of the total number of homes listed, they account for a disproportionately larger share of sales. This trend is indicative of sustained demand within this high-end segment—a demand that is not mirrored across the broader market spectrum.

- Market Stability Amidst Volatility: Despite the complexities of global economic factors, including tariff impacts, luxury real estate has demonstrated remarkable resilience. The first quarter of 2025 saw stability in this segment, offering a reprieve from the volatility that plagued other market segments.

Market Hotspots: Dominant Cities in Luxury Real Estate

The allure of luxury real estate is particularly evident in specific U.S. cities where demand remains steadfast. Notably, the Los Angeles metro area, a hub for million-dollar listings, surpasses regions like San Francisco and Boston, leading the luxury listings charge. These cities represent quintessential demand areas where luxury real estate continues to thrive.

What Drives the Robust Growth of Luxury Real Estate?

The underpinnings of the luxury real estate market’s growth can be associated with a myriad of factors:

- Economic Growth and Wealth Accumulation: An increase in high-net-worth individuals has naturally resulted in a heightened demand for luxurious real estate properties. Wealth accumulation affords more people the means to invest in high-end properties, further fueling demand.

- Investment Appeal: Beyond living spaces, high-value properties serve as investment vehicles offering significant returns on investment. This dual-purpose appeal continues to draw the moneyed class to luxury real estate.

- Exclusive Locations and Amenities: Luxury homes boast features and locations that are unparalleled, attracting prospective buyers looking for exclusivity and status. These homes often come equipped with state-of-the-art facilities and reside in prime, sought-after neighbourhoods.

Current Challenges and Market Dynamics

Despite its resilience, the luxury housing market is not immune to challenges. Economic factors such as inflation and global tariffs remain daunting obstacles that permeate through the real estate sector. However, the luxury segment, due to its distinct demographic and investment patterns, is often able to weave through these challenges more adeptly compared to the broader market.

As the luxury real estate market continues to chart its unique course, it offers interesting insights into the resilience and dynamism of high-value real estate investments. It propels forward despite external uncertainties, driven by demand from affluent buyers and investors. Given these factors, the luxury housing market remains not just a vital segment within the real estate industry but a barometer for economic vibrancy and market ingenuity.

Where Luxury Listings Live Before the Market Knows

As the luxury housing market continues its steady climb, access to the right deals at the right time is everything. POCKETLISTING is your insider pass to premium off-market properties, data-driven insights, and exclusive connections — all in one platform built for modern real estate pros and elite investors. Tap into tomorrow’s opportunities today.