Key Takeaways

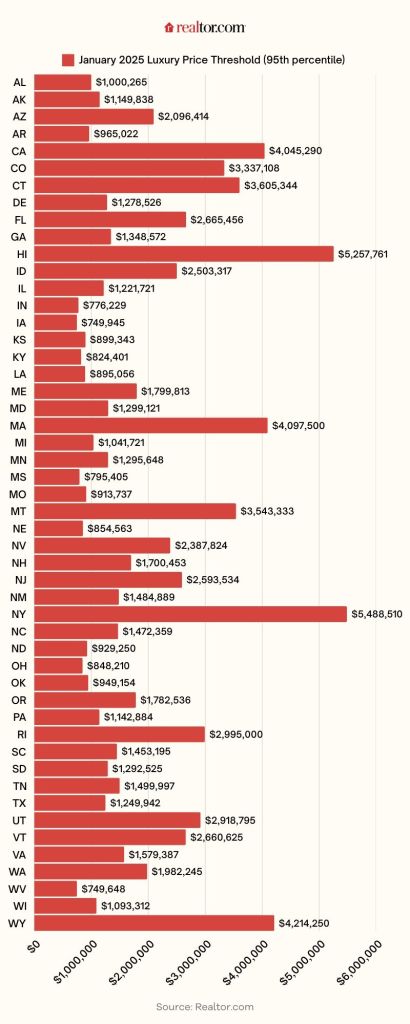

- Luxury home prices vary significantly across the U.S., with top states like New York and Hawaii having prices upward of $5 million, while more affordable states like West Virginia, Iowa, Indiana, and Mississippi have thresholds under $800,000.

- The minimum salary needed to afford a luxury home mortgage is calculated by looking at the top 5% of home prices and applying a 6.89% mortgage rate with a 20% downpayment and 30% income rule.

- Realtor.com’s data reveals that the definition of luxury greatly differs across states, leading to huge variance in housing costs and required income to sustain such properties.

- Key discussion point by Hannah Jones, a senior economic research analyst at Realtor.com, highlights the disparity in luxury home costs between states like New York and West Virginia.

- Examples showcase that a $5.49 million condo in New York contrasts sharply with a $750,000 home in West Virginia, illustrating diverse luxury living options within the U.S.

In the world of luxury real estate, the United States presents a vast and diverse marketplace with significant variations in home prices and income requirements. The cost and definition of luxury differ hugely across states, influenced by geographical location, regional economics, and local real estate trends. In this blog post, we will delve into the intricacies of buying upscale properties in America, examining high-end real estate pricing by state and providing insights into the factors aspiring luxury homeowners should consider when investing in premium real estate.

Understanding Luxury Home Pricing Across U.S. States

Luxury homes epitomize exclusivity, offering distinctive features and premium locations. However, the financial burden associated with purchasing such properties varies markedly across the United States. Realtor.com’s latest data highlights that luxury home prices can exceed $5 million in states like New York and Hawaii, while more affordable states such as West Virginia, Iowa, Indiana, and Mississippi have luxury thresholds below $800,000. This broad spectrum of pricing underscores the importance of understanding regional market dynamics when considering a luxury real estate investment.

Determining Affordability: Income and Mortgage Calculations for Luxury Homes

Buying a luxury home is as much about affording the purchase price as it is about managing ongoing financial commitments. To aid prospective buyers, Realtor.com has outlined methods of calculating affordability, including mortgage assessments which place a considerable emphasis on income. A minimum salary is determined by examining the top 5% of home prices and applying a 6.89% mortgage rate, 20% down payment, and a 30% income rule. This approach provides a structure for home buyers to gauge the financial feasibility of sustaining luxury property.

The Regional Definition of Luxury Real Estate

The definition of luxury is not universal; it varies substantially from one state to another. As Hannah Jones, a senior economic research analyst at Realtor.com, points out, this disparity profoundly impacts the housing costs and the financial inputs required to maintain luxury properties. For instance, a high-end condo in New York valued at $5.49 million can vastly differ from a $750,000 home in West Virginia, both meeting the luxury criteria for their respective locales. Understanding these nuances is crucial for buyers who are exploring upscale living options across different parts of the country.

Tips for Prospective Luxury Home Buyers

When diving into the luxury real estate market, several considerations can influence your purchasing decision and financial stability:

- Research Regional Markets: Understand how state economics, local real estate trends, and geographical location impact luxury home prices.

- Consult a Financial Advisor: Use professional resources when calculating mortgage affordability to ensure your financial health is maintained.

- Consider Lifestyle Preferences: The luxury home of your dreams should align with your lifestyle needs and future goals.

- Leverage Real Estate Professionals: Engage with local experts who understand the intricacies of the high-end market and can offer guidance tailored to your situation.

Luxury real estate in America offers incomparable opportunities for those looking to exude prestige and enjoy premium living. However, with the remarkable variance in prices and income requirements, it’s imperative to approach this market with informed strategies. By understanding regional market dynamics, calculating affordability intelligently, and leveraging professional insights, prospective buyers can navigate the luxury housing landscape with confidence and acumen.

Alabama

- January 2025 luxury price threshold (95th percentile): $1,000,265

- Monthly payment, excluding tax and insurance: $5,265

- Minimum recommended household income: $210,594

Alaska

- January 2025 luxury price threshold (95th percentile): $1,149,838

- Monthly payment, excluding tax and insurance: $6,052

- Minimum recommended household income: $242,085

Arizona

- January 2025 luxury price threshold (95th percentile): $2,096,414

- Monthly payment, excluding tax and insurance: $11,034

- Minimum recommended household income: $441,375

Arkansas

- January 2025 luxury price threshold (95th percentile): $965,022

- Monthly payment, excluding tax and insurance: $5,079

- Minimum recommended household income: $203,174

California

- January 2025 luxury price threshold (95th percentile): $4,045,290

- Monthly payment, excluding tax and insurance: $21,292

- Minimum recommended household income: $851,687

Colorado

- January 2025 luxury price threshold (95th percentile): $3,337,108

- Monthly payment, excluding tax and insurance: $17,565

- Minimum recommended household income: $702,588

Connecticut

- January 2025 luxury price threshold (95th percentile): $3,605,344

- Monthly payment, excluding tax and insurance: $18,977

- Minimum recommended household income: $759,062

Delaware

- January 2025 luxury price threshold (95th percentile): $1,278,526

- Monthly payment, excluding tax and insurance: $6,729

- Minimum recommended household income: $269,178

Florida

- January 2025 luxury price threshold (95th percentile): $2,665,456

- Monthly payment, excluding tax and insurance: $14,029

- Minimum recommended household income: $561,180

Georgia

- January 2025 luxury price threshold (95th percentile): $1,348,572

- Monthly payment, excluding tax and insurance: $7,098

- Minimum recommended household income: $283,926

Hawaii

- January 2025 luxury price threshold (95th percentile): $5,257,761

- Monthly payment, excluding tax and insurance: $27,674

- Minimum recommended household income: $1,106,959

Idaho

- January 2025 luxury price threshold (95th percentile): $2,503,317

- Monthly payment, excluding tax and insurance: $13,176

- Minimum recommended household income: $527,043

Illinois

- January 2025 luxury price threshold (95th percentile): $1,221,721

- Monthly payment, excluding tax and insurance: $6,430

- Minimum recommended household income: $257,219

Indiana

- January 2025 luxury price threshold (95th percentile): $776,229

- Monthly payment, excluding tax and insurance: $4,086

- Minimum recommended household income: $163,426

Iowa

- January 2025 luxury price threshold (95th percentile): $749,945

- Monthly payment, excluding tax and insurance: $3,947

- Minimum recommended household income: $157,892

Kansas

- January 2025 luxury price threshold (95th percentile): $899,343

- Monthly payment, excluding tax and insurance: $4,734

- Minimum recommended household income: $189,346

- Kentucky

- January 2025 luxury price threshold (95th percentile): $824,401

- Monthly payment, excluding tax and insurance: $4,339

- Minimum recommended household income: $173,568

- Louisiana

- January 2025 luxury price threshold (95th percentile): $895,056

- Monthly payment, excluding tax and insurance: $4,711

- Minimum recommended household income: $188,443

- Maine

- January 2025 luxury price threshold (95th percentile): $1,799,813

- Monthly payment, excluding tax and insurance: $9,473

- Minimum recommended household income: $378,929

Maryland

- January 2025 luxury price threshold (95th percentile): $1,299,121

- Monthly payment, excluding tax and insurance: $6,838

- Minimum recommended household income: $273,514

Massachusetts

- January 2025 luxury price threshold (95th percentile): $4,097,500

- Monthly payment, excluding tax and insurance: $21,567

- Minimum recommended household income: $862,680

Michigan

- January 2025 luxury price threshold (95th percentile): $1,041,721

- Monthly payment, excluding tax and insurance: $5,483

- Minimum recommended household income: $219,322

Minnesota

- January 2025 luxury price threshold (95th percentile): $1,295,648

- Monthly payment, excluding tax and insurance: $6,820

- Minimum recommended household income: $272,783

Mississippi

- January 2025 luxury price threshold (95th percentile): $795,405

- Monthly payment, excluding tax and insurance: $4,187

- Minimum recommended household income: $167,463

Missouri

- January 2025 luxury price threshold (95th percentile): $913,737

- Monthly payment, excluding tax and insurance: $4,809

- Minimum recommended household income: $192,376

Montana

- January 2025 luxury price threshold (95th percentile): $3,543,333

- Monthly payment, excluding tax and insurance: $18,650

- Minimum recommended household income: $746,006

Nebraska

- January 2025 luxury price threshold (95th percentile): $854,563

- Monthly payment, excluding tax and insurance: $4,498

- Minimum recommended household income: $179,918

Nevada

- January 2025 luxury price threshold (95th percentile): $2,387,824

- Monthly payment, excluding tax and insurance: $12,568

- Minimum recommended household income: $502,728

New Hampshire

- January 2025 luxury price threshold (95th percentile): $1,700,453

- Monthly payment, excluding tax and insurance: $8,950

- Minimum recommended household income: $358,010

New Jersey

- January 2025 luxury price threshold (95th percentile): $2,593,534

- Monthly payment, excluding tax and insurance: $13,651

- Minimum recommended household income: $546,038

New Mexico

- January 2025 luxury price threshold (95th percentile): $1,484,889

- Monthly payment, excluding tax and insurance: $7,816

- Minimum recommended household income: $312,626

New York

- January 2025 luxury price threshold (95th percentile): $5,488,510

- Monthly payment, excluding tax and insurance: $28,889

- Minimum recommended household income: $1,155,540

North Carolina

- January 2025 luxury price threshold (95th percentile): $1,472,359

- Monthly payment, excluding tax and insurance: $7,750

- Minimum recommended household income: $309,988

North Dakota

- January 2025 luxury price threshold (95th percentile): $929,250

- Monthly payment, excluding tax and insurance: $4,891

- Minimum recommended household income: $195,642

Ohio

- January 2025 luxury price threshold (95th percentile): $848,210

- Monthly payment, excluding tax and insurance: $4,465

- Minimum recommended household income: $178,580

Oklahoma

- January 2025 luxury price threshold (95th percentile): $949,154

- Monthly payment, excluding tax and insurance: $4,996

- Minimum recommended household income: $199,833

Oregon

- January 2025 luxury price threshold (95th percentile): $1,782,536

- Monthly payment, excluding tax and insurance: $9,382

- Minimum recommended household income: $375,292

Pennsylvania

- January 2025 luxury price threshold (95th percentile): $1,142,884

- Monthly payment, excluding tax and insurance: $6,016

- Minimum recommended household income: $240,621

Rhode Island

- January 2025 luxury price threshold (95th percentile): $2,995,000

- Monthly payment, excluding tax and insurance: $15,764

- Minimum recommended household income: $630,561

South Carolina

- January 2025 luxury price threshold (95th percentile): $1,453,195

- Monthly payment, excluding tax and insurance: $7,649

- Minimum recommended household income: $305,953

South Dakota

- January 2025 luxury price threshold (95th percentile): $1,292,525

- Monthly payment, excluding tax and insurance: $6,803

- Minimum recommended household income: $272,126

Tennessee

- January 2025 luxury price threshold (95th percentile): $1,499,997

- Monthly payment, excluding tax and insurance: $7,895

- Minimum recommended household income: $315,806

Texas

- January 2025 luxury price threshold (95th percentile): $1,249,942

- Monthly payment, excluding tax and insurance: $6,579

- Minimum recommended household income: $263,160

Utah

- January 2025 luxury price threshold (95th percentile): $2,918,795

- Monthly payment, excluding tax and insurance: $15,363

- Minimum recommended household income: $614,517

Vermont

- January 2025 luxury price threshold (95th percentile): $2,660,625

- Monthly payment, excluding tax and insurance: $14,004

- Minimum recommended household income: $560,163

Virginia

- January 2025 luxury price threshold (95th percentile): $1,579,387

- Monthly payment, excluding tax and insurance: $8,313

- Minimum recommended household income: $332,521

Washington

- January 2025 luxury price threshold (95th percentile): $1,982,245

- Monthly payment, excluding tax and insurance: $10,433

- Minimum recommended household income: $417,338

West Virginia

- January 2025 luxury price threshold (95th percentile): $749,648

- Monthly payment, excluding tax and insurance: $3,946

- Minimum recommended household income: $157,829

Wisconsin

- January 2025 luxury price threshold (95th percentile): $1,093,312

- Monthly payment, excluding tax and insurance: $5,755

- Minimum recommended household income: $230,184

Wyoming

- January 2025 luxury price threshold (95th percentile): $4,214,250

- Monthly payment, excluding tax and insurance: $22,181

- Minimum recommended household income: $887,260

Access Exclusive Luxury Real Estate

America’s luxury real estate market is constantly evolving, and the most sought-after properties are often secured before they hit the public market. POCKETLISTING provides exclusive access to off-market luxury homes across the country, connecting buyers, sellers, and investors with premier opportunities.

Looking for your next high-end investment or dream home? Visit pocketlisting.io today and gain insider access to the most elite properties in the U.S.