Key Takeaways

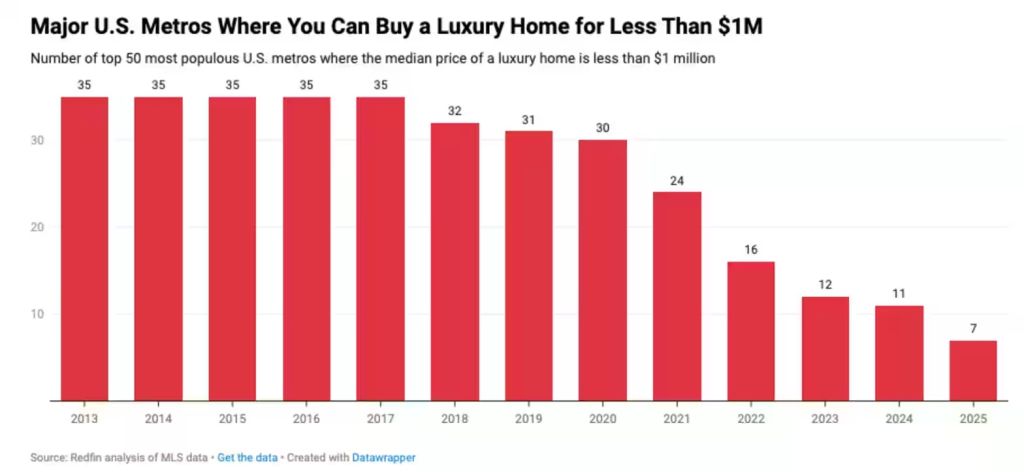

- Only seven large U.S. cities have luxury homes priced under $1 million, with six located in the Midwest.

- Luxury home prices have surged 88% nationally over the past decade, affecting availability in many metropolitan areas.

- Detroit tops the list for affordable luxury homes, with a median price of $753,851, a growth of 80.1% in ten years.

- Investor selling activity reached a record high, making up 10.8% of all homes sold, benefiting end-users and first-time buyers.

- Small investors (fewer than 10 homes) accounted for 59.2% of investor purchases in the last year, marking the highest share recorded.

- Regions with the most investor activity included the Midwest and South, particularly Missouri and Oklahoma.

- Cash sales by investors decreased, indicating a shift in purchasing strategies amid high interest rates.

The luxury real estate market in the United States is undergoing a significant transformation. While high-end home prices have skyrocketed over the past decade, a closer look reveals intriguing opportunities for savvy investors and homebuyers. This blog post delves into the current state of the luxury housing market, highlighting cities with affordable options, analyzing investor activity trends, and offering insights into purchasing strategies in today’s dynamic market.

Luxury Homes: A Changing Landscape

High-End Real Estate Over the Decade

Over the past ten years, luxury home prices in the U.S. have surged by 88%. This substantial increase has dramatically changed the landscape, with fewer cities offering six-figure luxury homes. However, there remain seven large U.S. cities where potential homeowners can still purchase luxury homes for less than $1 million. Notably, six of these cities are located in the Midwest, revealing a pocket of affordability amidst a sea of rising prices.

Spotlight on Affordable Cities

Among the cities with affordable luxury homes, Detroit stands out. With a median price of $753,851 and an 80.1% growth over the decade, Detroit offers a striking opportunity for luxury buyers. Other cities in this exclusive club include Cleveland, Pittsburgh, Indianapolis, St. Louis, Cincinnati, and San Antonio, Texas—the lone representative outside the Midwest.

| Major metros where the typical luxury home costs less than $1 million | ||||

| Metro | Median luxury home sale price (2025) | Median luxury home sale price (2020) | Median luxury home sale price (2015) | Price Growth 2015 → 2025 |

| Detroit, MI | $753,851 | $532,706 | $415,955 | 81.2% |

| Cleveland, OH | $757,046 | $531,461 | $476,170 | 59.0% |

| Pittsburgh, PA | $846,715 | $618,837 | $552,799 | 53.2% |

| Indianapolis, IN | $914,276 | $616,613 | $553,161 | 65.3% |

| St. Louis, MO | $914,453 | $677,578 | $602,076 | 51.9% |

| Cincinnati, OH | $931,145 | $600,709 | $547,238 | 70.2% |

| San Antonio, TX | $957,854 | $656,438 | $567,799 | 68.7% |

| United States | $1,348,065 | $797,903 | $717,004 | 88.0% |

The Investor Influence

Heightened Investor Activity

Investor selling activity has reached unprecedented levels, with investors making up 10.8% of all home sales last year. This trend has significant implications for end-users and first-time buyers, offering them a chance to enter the market with less competition from investors.

Notably, small investors (those with fewer than ten properties) dominate the landscape, accounting for 59.2% of all investor purchases. In contrast, large investors (those purchasing 50 or more properties) have seen a decline in their footprint, reflecting a strategic shift in the market.

Regional Hotspots

Investor activity is particularly pronounced in the Midwest and Southern regions, with Missouri and Oklahoma leading the charge. These areas present fertile ground for investors due to their affordability and growth potential.

Navigating the Market: Buyer Strategies

Adjusting to High Prices

For those considering entering the luxury market, understanding these trends is crucial. Prospective buyers should look towards cities like Detroit, where growth potential remains high despite the affordability factor. The Midwest offers a unique blend of price competitiveness and historical charm, providing an enticing option for luxury buyers.

Investors Adjusting Their Tactics

Amidst rising interest rates, investor purchasing strategies are evolving. The decline in all-cash sales suggests a pivot towards financing options. Buyers can take advantage of this shift by exploring financing arrangements that suit their financial goals.

The luxury real estate market in the U.S. is complex and ever-changing. While high-end property prices continue to rise, opportunities abound in select markets. By staying informed and adaptable, potential buyers and investors can navigate this dynamic environment to their advantage.

Discover Off-Market Luxury Deals

POCKETLISTING gives you access to off-market deals and emerging luxury markets before they hit the mainstream. Whether you’re an investor or future homeowner, we help you find high-end properties others miss.